Low Level of Skilled Nursing Occupancy Persists in October

December 30, 2021

“In many parts of the country the occupancy challenge is not a demand issue, but a labor supply issue”

– Bill Kauffman

NIC MAP® Data Service, powered by NIC MAP Vision, released its latest Skilled Nursing Monthly Report on December 30, 2021. The report includes key monthly data points from January 2012 through October 2021.

Here are some key takeaways from the report:

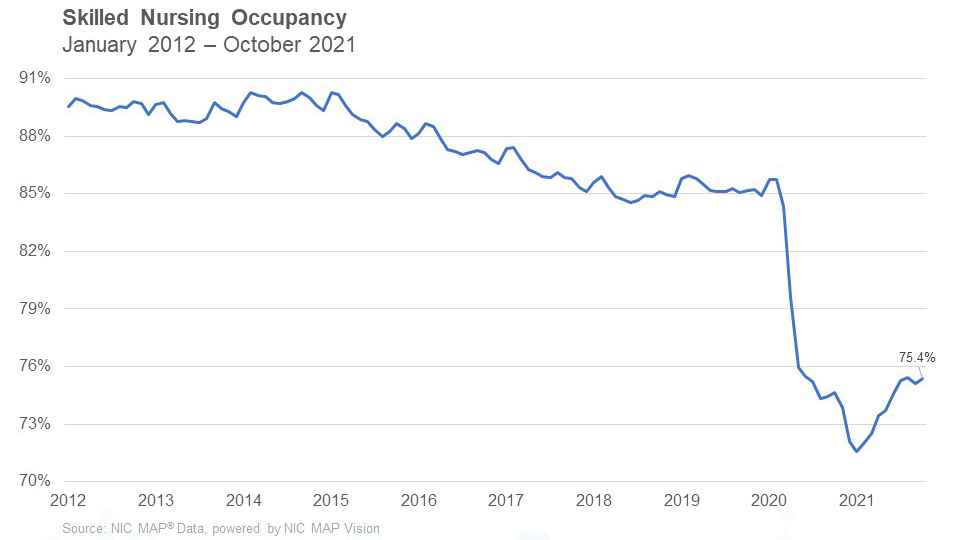

Skilled nursing property occupancy increased 28 basis points in October to 75.4%, reversing a similarly- sized decline in September. The occupancy rate is now 382 basis points above the low point reached in January 2021 (71.6%.) The cautious optimism for a recovery in occupancy at the beginning of 2021 was challenged by the rapid spread of the contagious COVID-19 Delta variant over the summer. Another factor that became more evident as 2021 progressed was the severe labor shortage in the sector, which has continued to cause many properties to limit admissions and subsequently slowed the recovery in occupancy. The question remains as to how fast the industry can increase occupancy to a sustainable level as staffing shortages are likely to remain challenging in 2022. Additional challenges may be on the horizon with the arrival of the fall/winter season and as the new Omicron variant becomes dominant. Occupancy remains very low compared to February 2020 pre-pandemic levels of 85.8% (10.4 percentage points.)

Managed Medicare revenue per patient day (RPPD) resumed its downtrend in October and fell 0.2% to $448.69. It is now down 3.3% from year-earlier levels and has been declining since NIC began reporting this data in 2012. This persistent decline in managed Medicare RPPD continues to result in an expanded reimbursement differential between Medicare fee-for-service and managed Medicare, which has accelerated during the pandemic. Medicare fee-for-service RPPD ended October 2021 at $570.25 and managed Medicare ended at $448.69, representing a $121.57 difference. Pre-pandemic, in February of 2020, the differential was $96. Meanwhile, Managed Medicare revenue mix held relatively steady from September to October at 10.4%. It is down from its 2021 high of 11.2% in February but is up from the pandemic low set in May 2020 of 8.4%. Managed Medicare admissions to skilled nursing properties have increased from pandemic lows when elective surgeries were suspended, but they are likely lower than before the pandemic.

Medicare revenue mix increased from September to October. However, it has also been trending down since January 2021, dropping 455 basis points to 20.2%. This suggests that utilization of the 3-Day Rule waiver fell as COVID-19 cases declined relative to the month of January. The 3-Day Rule waiver was implemented by Centers for Medicare and Medicaid Services (CMS) to eliminate the need to transfer positive COVID-19 patients back to the hospital to qualify for a Medicare-paid skilled nursing stay, hence increasing the Medicare census at properties. Medicare RPPD increased from $566 in September to $570 in October. Some of this increase is likely a result of the increase in Medicare rates to skilled nursing properties for fiscal year 2022. However, it has decreased 0.8% from one year ago which is most likely due to less reimbursement needed for COVID-19 positive patients. During the pandemic, there has been support from the federal government to increase Medicare fee-for-service reimbursements for COVID-19 positive patients requiring isolation. Resident COVID-19 cases are now lower compared to October 2020, according to NIC’s Skilled Nursing COVID-19 Tracker.

Medicaid RPPD increased from September to end October at $249. Medicaid RPPD was trending downward from January 2021 through June but started to increase in July which suggests additional reimbursement for COVID-19 positive patients as the Delta variant spread over the summer. Medicaid reimbursement has increased more than usual as many states acted to increase reimbursement related to COVID-19. This latest monthly data shows a 5.2% increase since February 2020, prior to the pandemic. Covering the cost of care for Medicaid patients is still a major concern as reimbursement does not cover the cost in many states. Nursing home wage growth is elevated, as is inflation as measured by the Consumer Price Index (CPI,) and staffing shortages are a significant challenge around the country. Expectations are that wage growth will remain elevated as staffing challenges persist into 2022.

To get more trends from the latest data download the Skilled Nursing Monthly Report. There is no charge for this report.

The report provides aggregate data at the national level from a sampling of skilled nursing operators with multiple properties in the United States. NIC continues to grow its database of participating operators to provide data at localized levels in the future. Operators who are interested in participating can complete a participation form. NIC maintains strict confidentiality of all data it receives.

—-

This blog was originally published on NIC Notes.

About NIC

The National Investment Center for Seniors Housing & Care (NIC), a 501(c)(3) organization, works to enable access and choice by providing data, analytics, and connections that bring together investors and providers. The organization delivers the most trusted, objective, and timely insights and implications derived from its analytics, which benefit from NIC’s affiliation with NIC MAP Vision, the leading provider of comprehensive market data for senior housing and skilled nursing properties. NIC events, which include the industry’s premiere conferences, provide sector stakeholders with opportunities to convene, network, and drive thought-leadership through high-quality educational programming. To see all that NIC offers, visit nic.org.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.