Skilled Nursing Medicare Mix Increased Significantly Due to Omicron

March 31, 2022

“In periods when increased cases of COVID-19 occur at properties around the country, residents require isolation and higher skilled care, allowing operators to bill at the Medicare rate instead of Medicaid. As cases decline, you will see the mix revert back.”

NIC MAP® data, powered by NIC MAP Vision, released its latest Skilled Nursing Monthly Report on March 31, 2022. The report includes key monthly data points from January 2012 through January 2022.

Here are some key takeaways from the report:

Occupancy

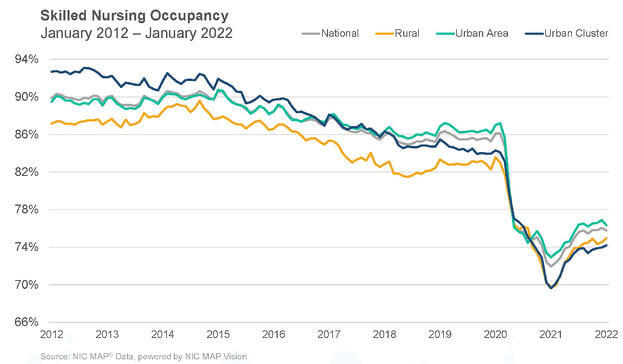

After reaching a 19-month high level of 76.1% in December 2021, skilled nursing property occupancy fell 27 basis points to start the 2022 new year at 75.8%. The Omicron variant caused COVID-19 cases around the country to spike at the beginning of the year, which seemingly stalled the occupancy recovery. Occupancy had been relatively flat since July 2021 but the January reversal pushed occupancy to being only 383 basis points above the low point reached in January 2021 (72.0%) and it remains low compared to the February 2020 pre-pandemic level of 86.1%. The COVID-19 delta variant over the summer months and more recently the Omicron variant posed challenges to growing occupancy further. In many instances heightened absenteeism associated with sickness related to Omicron and restrictions on when staff could return to work safely caused many operators to limit patient admissions because they were unable to have sufficient numbers of staff to care for patients. With a national unemployment rate of 3.8% in February 2022 and the number of skilled nursing workers at the national level remaining 15% below pre-pandemic levels, the labor crisis is unlikely to abate anytime soon.

Medicare

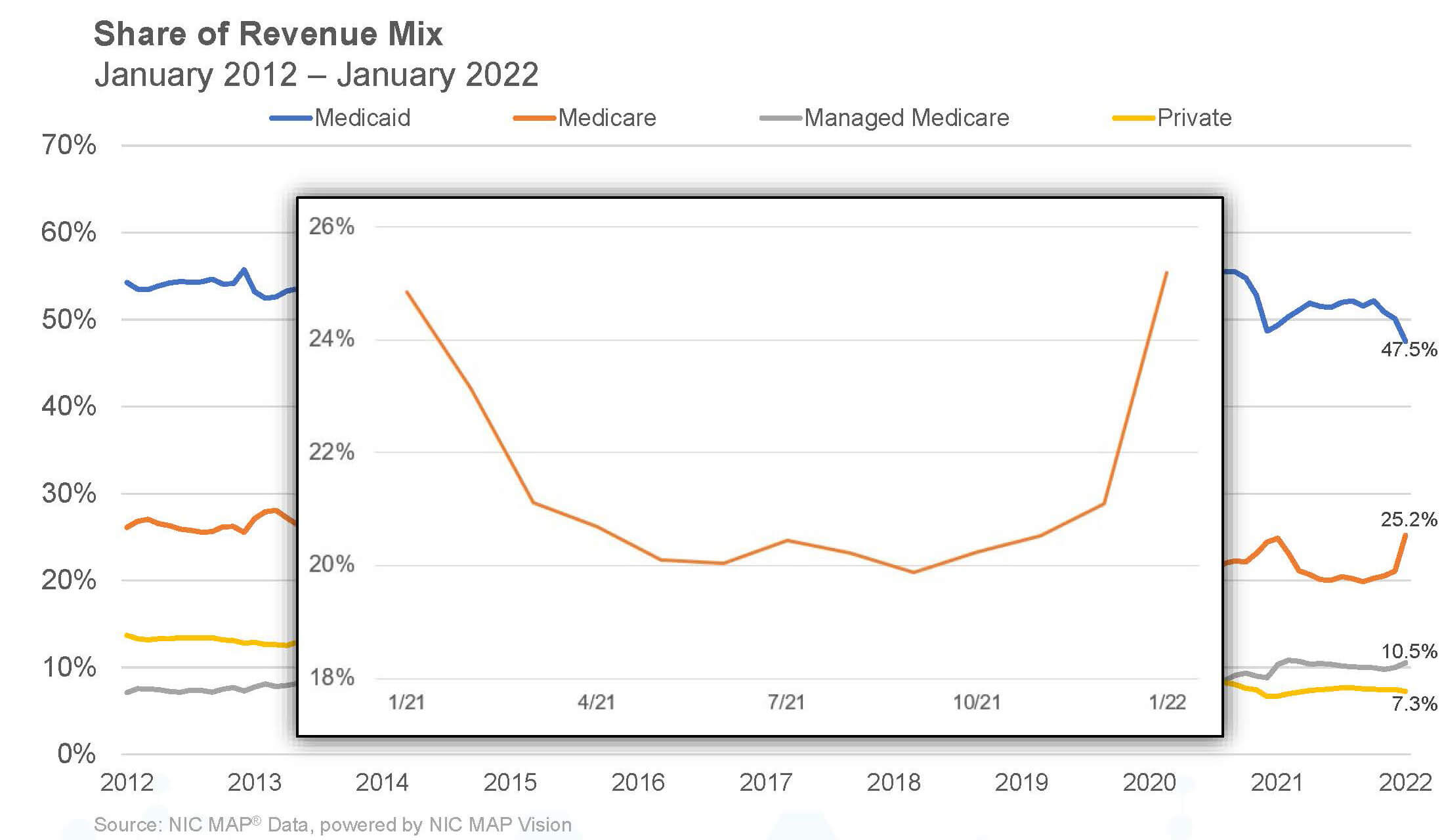

Medicare revenue per patient day (RPPD) increased slightly from December 2021 to end January 2022 at $585. This was an increase from $580 in December and its highest level since June 2020. The January increase was likely due to the need for more skilled care as some residents contracted the Omicron variant. The federal government implemented many initiatives to aid operators of properties for cases of COVID-19, including increases in Medicare fee-for-service reimbursements to help care for COVID-19 positive patients requiring additional care. Meanwhile, Medicare revenue mix also trended up in the month of January, increasing 411 basis points from 21.1% to reach a pandemic high of 25.2%. Given the elevated number of COVID-19 cases in January, this suggests there was a significant uptick in the utilization of the 3-Day Rule waiver as COVID-19 cases increased in the month of January. The 3-Day Rule waiver was implemented by Centers for Medicare and Medicaid Services (CMS) to eliminate the need to transfer positive COVID-19 patients back to the hospital to qualify for a Medicare paid skilled nursing stay, hence increasing the Medicare census at properties. As the cases decline, the Medicare revenue share is likely to decline as well.

Managed Care

Managed Medicare revenue mix increased 54 basis points from December to end January at 10.5%. This was up 258 basis points from pandemic low set in May 2020 of 8.0%, but 57 basis points below the most recent highwater mark of 11.1% prior to the pandemic. The increase is likely due to growth in elective surgeries from the early days of pandemic, which typically creates additional referrals to skilled nursing properties. Meanwhile, Managed Medicare revenue per patient day (RPPD) inched up from $453 to $454 in January and has fluctuated around this value since August. Compared to its year-earlier value of $468, it is down 2.9%, however and it is down $106 (19%) from January 2012. It continues to create pressure on operators’ revenue as managed Medicare enrollment continues to expand its reach and coverage around the country. The persistent decline in managed Medicare revenue per patient day continues to result in an expanded reimbursement differential between Medicare fee-for-service and managed Medicare, which has accelerated during the pandemic. Medicare fee-for-service RPPD ended January 2022 at $585, representing a $130 difference. Pre-pandemic, in February of 2020, the differential was $99.

Medicaid

As Omicron cases spiked in January, Medicaid patient day mix decreased 269 basis points to 63.7%. It has decreased 313 basis points from the most recent high set in in September 2021. In a similar trend, Medicaid revenue mix deceased in January, declining 258 basis points to 47.5%. As mentioned above, this was likely due to the spike in Omicron cases in January as operators moved residents from Medicaid to Medicare days as they required isolation and higher skilled care. Meanwhile, Medicaid revenue per patient day (RPPD) decreased 1.6% from December 2021 to end January 2022 at $245. After hitting a high of $249 in October 2021, it is now at a level last seen in May of 2021. However, Medicaid reimbursement has increased more than usual as many states embraced measures to increase reimbursement related to the number of COVID-19 cases. Medicaid has increased 3.4% since February 2020. On the other hand, covering the cost of care for Medicaid patients is still a major concern as reimbursement does not cover the cost of care in many states. In addition, nursing home wage growth is elevated along with overall inflation, and staffing shortages are a significant challenge in many areas of the country.

To get more trends from the latest data you can download the Skilled Nursing Monthly Report. There is no charge for this report.

The report provides aggregate data at the national level from a sampling of skilled nursing operators with multiple properties in the United States. NIC continues to grow its database of participating operators to provide data at localized levels in the future. Operators who are interested in participating can complete a participation form. NIC maintains strict confidentiality of all data it receives.

—-

This blog was originally published on NIC Notes.

About NIC

The National Investment Center for Seniors Housing & Care (NIC), a 501(c)(3) organization, works to enable access and choice by providing data, analytics, and connections that bring together investors and providers. The organization delivers the most trusted, objective, and timely insights and implications derived from its analytics, which benefit from NIC’s affiliation with NIC MAP Vision, the leading provider of comprehensive market data for senior housing and skilled nursing properties. NIC events, which include the industry’s premiere conferences, provide sector stakeholders with opportunities to convene, network, and drive thought-leadership through high-quality educational programming. To see all that NIC offers, visit nic.org.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.