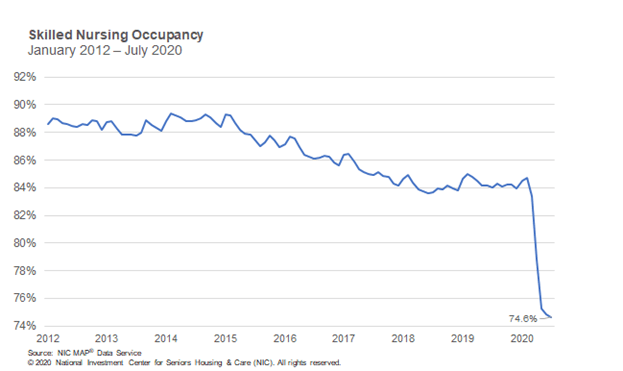

Skilled Nursing Occupancy 74.6% in July

October 2, 2020

Managed Medicare revenue mix increases, first time since start of pandemic

NIC MAP® Data Service released its latest Skilled Nursing Monthly Report on September 29, 2020, which includes key monthly data points from January 2012 through July 2020.

Here are some key takeaways from the report:

1. Occupancy decreased in July and slipped to 74.6%, 10.1 percentage points below its February rate of 84.7% and 9.4 percentage points below its year-earlier level of 84.0%. The occupancy decline was larger in urban areas, which have seen an 11.4 percentage point decrease in occupancy since February to 74.6%, versus rural areas which have seen a smaller 6.2 percentage point drop to 75.6%. Urban areas had a higher starting occupancy level in February (86.1% versus 81.9%). Looking ahead as the Fall/Winter seasons approach, there is much uncertainty regarding occupancy with the potential of an acceleration in COVID-19 cases and the arrival of flu season.

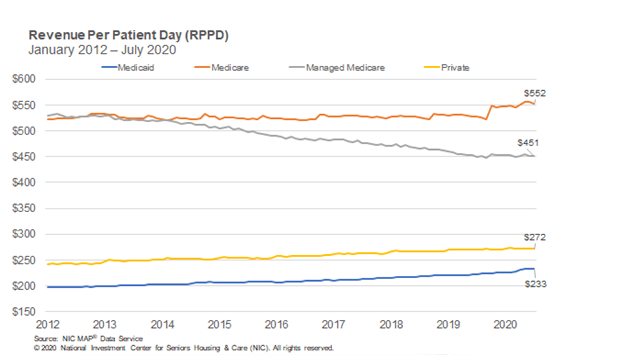

2. Managed Medicare revenue mix increased for the first time since the pandemic started in March. It increased 37 basis points from 7.6% in June to 8.0% in July. Although a smaller portion of revenue than Medicaid and Medicare, the increase in managed Medicare revenue mix suggests admissions may be stabilizing as many states have lifted the suspension of elective surgeries. However, managed Medicare revenue mix is down 187 basis points since March and down 193 basis points from last year in July of 2019. Meanwhile, Managed Medicare revenue per patient day (RPPD) decreased 0.23% from $451.87 to $450.82 in July. Managed Medicare RPPD has increased during the pandemic, albeit slightly, suggesting the significant pressure of declining reimbursement rates have eased, at least during this crisis period. It is up 0.32% since March. However, the pressure on reimbursement has been evident within the data series as RPPD has declined $78 since January 2012, representing a 14.7% decline during that time.

3. Medicare revenue per patient day (RPPD) decreased for the first time since the pandemic started in March. It fell 0.75% from $556.26 in June to $552.08 in July. However, Medicare RPPD is up 1.11% since March when it was $546.01 The increase since March is likely because of additional reimbursement due to COVID-19 positive-tested patients requiring isolation, in addition to the temporary suspension of the 2.0% sequestration cuts by CMS, which are effective from May 1 through December 31, 2020. Medicare RPPD is up 4.8% since last year in July of 2019. Meanwhile, Medicare revenue mix continues to be relatively steady as it increased 26 basis points from June to 20.8% in July. Since March, it is only down 63 basis points compared to Medicaid revenue mix which is down 180 basis points and managed Medicare which is down 187 basis points.

4. Medicaid revenue mix increased 28 basis points from 48.6% in June to 48.9% in July. It is down 180 basis points from 50.7% in March. Total Medicaid patient days likely decreased since March, due to lower overall admissions and some Medicaid patients who may have converted to Medicare due to the waiver of the 3-Day Rule during this crisis period. Meanwhile, Medicaid RPPD held steady at $233 from June to July, but has increased 2.5% since March as states embraced measures to help skilled nursing properties such as increasing reimbursement related to the number of COVD-19 cases at properties. However, current Medicaid RPPD does not cover the actual cost of care in most states.

To access more trends from the latest data, download the Skilled Nursing Monthly Report.

The report provides aggregate data at the national level from a sampling of skilled nursing operators with multiple properties in the United States. NIC continues to grow its database of participating operators in order to provide data at localized levels in the future. Operators who are interested in participating can complete a participation form here. NIC maintains strict confidentiality of all data it receives.

About Bill Kauffman

Senior Principal Bill Kauffman works with the research team in providing research and analysis in various areas including sales transactions and skilled nursing. He has lead roles in creating new and enhanced products and implementation of new processes. Prior to joining NIC he worked at Shelter Development in investing/acquiring, financing, and asset management for over $1 billion in assets. He also had key roles in the value creation and strategic planning and analysis for over 65 entities. He received his Bachelor of Business Administration in Finance from the College of Business and Economics at Radford University and his Master of Science in Finance from Loyola College in Maryland. He also holds the Chartered Financial Analyst Designation (CFA).

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.