Skilled Nursing Staffing Shortages May Have Peaked but Cycle Continues

October 13, 2022

With wage inflation and continued labor market challenges and shortages, skilled nursing operators and owners face steep competition relative to other industries (i.e., indirectly from other service industries such as hotels and restaurants) especially those operating in regions and states where broad labor availability is tight and employer demand is high. Additionally, amid generally low occupancy levels, skilled nursing owners and operators face challenges over the long term with new and proposed staffing mandates and requirements.

The greatest shortages of healthcare staff continue to be among essential workers such as nursing staff and aides, the backbone of the skilled nursing sector. This blog post explores underlying staffing shortages data among nursing staff and aides in the skilled nursing industry from three perspectives: location (region), property-level occupancy, and the size of the property. Further, it examines how the ongoing staffing crisis affects skilled nursing properties based on these three measures and includes an interactive dashboard to explore the varying combinations of these measures on resulting levels of properties’ staff shortages.

As background, according to the latest Bureau of Labor Statistics (BLS) data, the seasonally adjusted number of employees at skilled nursing properties increased to 1,361,000 in September 2022, up 18,300 jobs from its pandemic low of 1,342,700 in March 2022. Despite these recent job gains, employment in skilled nursing is still 220,200 jobs below pre-pandemic March 2020 levels (1,581,200), equivalent to negative 13.9%, and 312,600 jobs below its peak of 1,673,600 in September 2011, equivalent to negative 18.7%

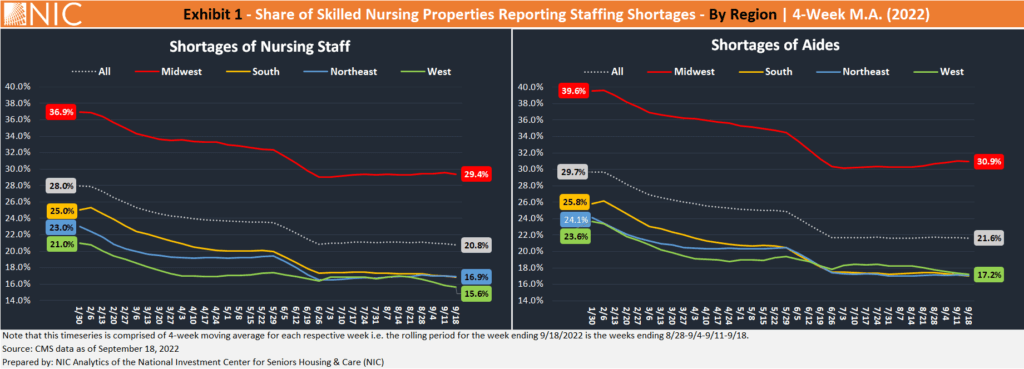

Staffing shortages likely hit their peak earlier this year in January 2022 and started to ease since. Notably, the share of skilled nursing properties reporting shortages of nursing staff dropped from 28.0% in January 2022 to 20.8% in September 2022, and the share of skilled nursing properties reporting shortages of aides dropped from 29.7% to 21.6% over the same period, according to the Nursing Home COVID-19 Public File (CMS data as of September 18, 2022, compiled by NIC Analytics).

By Region. As Exhibit 1 below shows, no region has been spared the scarcity of nursing staff and aides. However, staffing shortages in the Midwest have been acute. About 37% of skilled nursing properties in the Midwest reported shortages of nursing staff, and nearly 40% reported shortages of aides back in January 2022, the highest levels recorded since the onset of the pandemic, across all U.S. regions.

By mid-September 2022, as staffing shortages slightly eased, about 30% of skilled nursing properties in the Midwest reported shortages of nursing staff and aides, nearly twice that of the South, Northeast, and West regions.

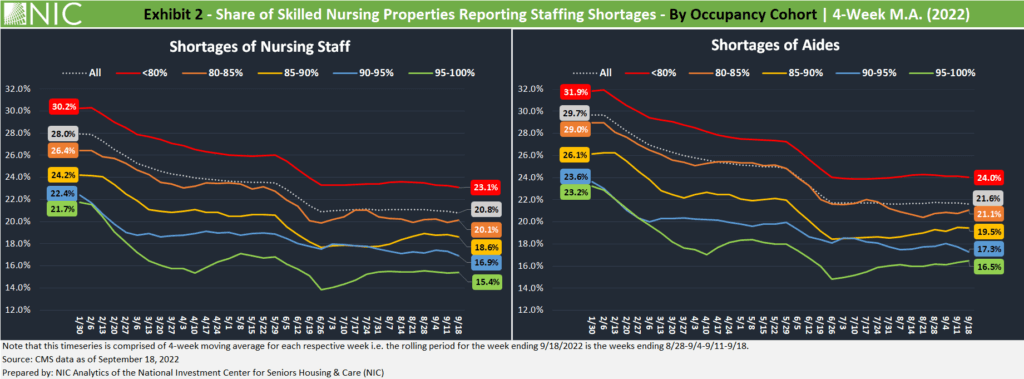

By Occupancy. The pandemic stretched finances for many skilled nursing operators, and the relatively slow pace of occupancy recovery is an additional challenge. Just like the employment trends, occupancy for skilled nursing properties is recovering but remains far below pre-pandemic levels. The relationship between labor and occupancy and conversely for occupancy and labor is synergistic and a bit of a chicken and egg scenario. In some instances, if labor isn’t available, new patients cannot be admitted, but if patients cannot be admitted, occupancy cannot be improved. The key question is what are the potential solutions to break this challenging cycle and help skilled nursing properties be competitive in attracting staff, improving occupancy, and providing the best and needed care for patients?

Exhibit 2 below shows that the higher the occupancy, the lower the share of skilled nursing properties reporting shortages of nursing staff and aides. Notably, skilled nursing properties with an occupancy rate below 80% had, and continue to have, the highest proportion of properties indicating a shortage in nursing staff and aides. By comparison, skilled nursing properties within higher occupancy cohorts have been reporting relatively lower shares of properties experiencing shortages of nursing staff and aides.

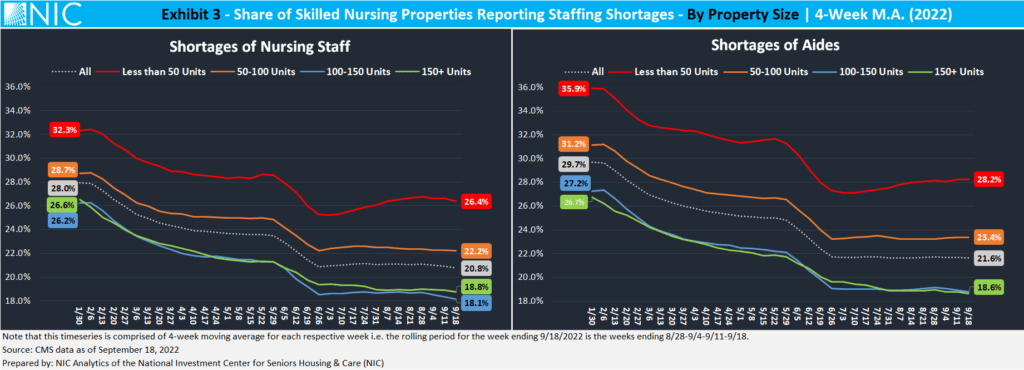

By Property Size. Another way to look at this data is by property size or total units. Interestingly, the highest share of skilled nursing properties reporting staffing shortages has been among small properties (less than 50 units). Exhibit 3 below illustrates that small properties tend to have a higher share reporting shortages of nursing staff and aides, and vice versa. In general, the smaller the property, the more volatile the occupancy due to the impact of just a few moveouts. This may impact staffing as well across these smaller properties, especially if they are not part of a larger portfolio.

Taking just these three variables into account — property location, occupancy, and size — staffing shortages vary substantially. For example, finding and hiring staff can be more challenging for small properties (less than 50 units) in the Midwest, with an occupancy rate less than 80%. In fact, the interactive dashboard below tracks closely these measures and indicates that about 40% of skilled nursing properties within this group reported shortages of nursing staff and aides for the week ending September 25, 2022, the highest share of any other combination of these three measures.

Conversely, less than 5% of relatively larger skilled nursing properties (100+ units) in the West, with an occupancy rate of 90% or more, reported shortages of nursing staff and aides, the lowest share of any other combination of these three measures.

To monitor these staffing shortage measures at the state and county levels over time, visit NIC’s Skilled Nursing COVID-19 Tracker.

—-

This blog was originally published on NIC Notes.

About NIC

The National Investment Center for Seniors Housing & Care (NIC), a 501(c)(3) organization, works to enable access and choice by providing data, analytics, and connections that bring together investors and providers. The organization delivers the most trusted, objective, and timely insights and implications derived from its analytics, which benefit from NIC’s affiliation with NIC MAP Vision, the leading provider of comprehensive market data for senior housing and skilled nursing properties. NIC events, which include the industry’s premiere conferences, provide sector stakeholders with opportunities to convene, network, and drive thought-leadership through high-quality educational programming. To see all that NIC offers, visit nic.org.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.