Employment Up 467,000 Positions in January, Despite Omicron

February 4, 2022

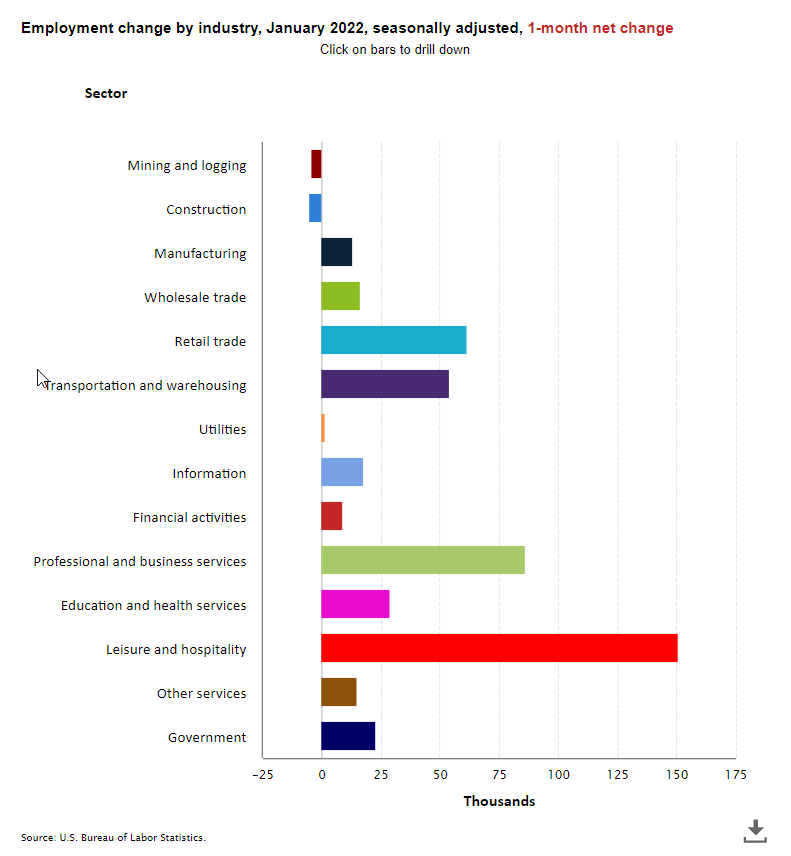

The Labor Department reported that nonfarm payrolls rose by 467,000 in January 2022. This was stronger than market expectations of an increase of 125,000 and occurred despite the impact of Omicron on the economy. Many analysts had expected the employment numbers to be negatively affected by absenteeism and self-isolation driven by the Omicron virus wave. January’s gain compared relatively favorably to the average monthly gain of 555,000 seen in 2021 and will support the Federal Reserve’s intention of raising interest rates as soon as March. Revisions added 709,000 to total payrolls in the previous two months. Nonfarm payrolls have now increased by 19.1 million since their pandemic trough in April 2020 but are still down by 2.9 million or 1.9% from their pre-pandemic level in February 2020.

Concerns about rising wage costs and inflation are further supported by this report. Average hourly earnings for all employees on private nonfarm payrolls rose by $0.23 in January to $31.63, a gain of 5.7% from a year earlier.

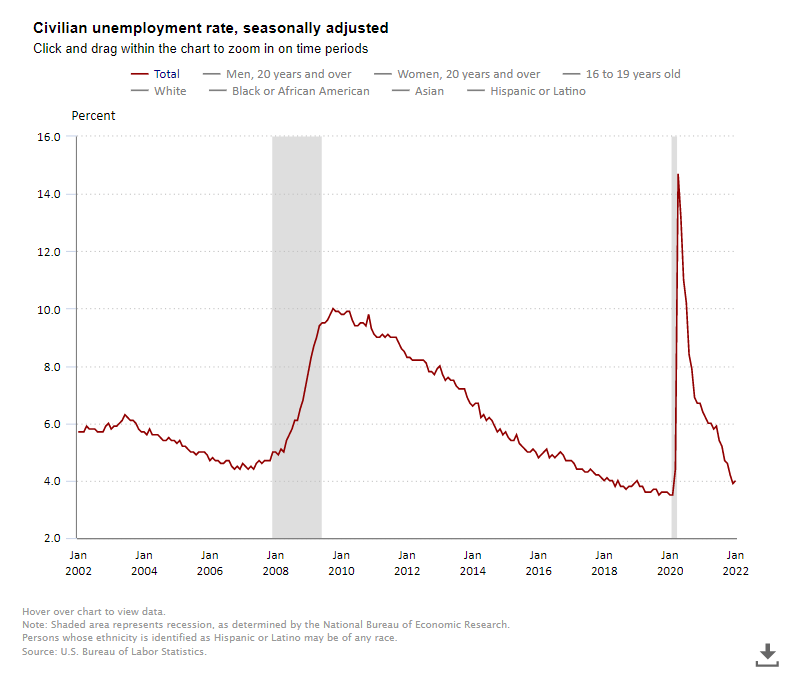

In a separate survey conducted by the BLS, the jobless rate edged up by 0.1 percentage point to 4.0% in January 2022, down 2.4 percentage points from year-earlier levels. The jobless rate is now 0.5 percentage points above the pre-pandemic level of 3.5% seen in February 2020, and well below the 14.7% peak seen in April 2020.

The underemployment rate or the U-6 jobless rate was 7.1%, down from 7.3% in December 2021. This figure includes those who have quit looking for a job because they are discouraged about their prospects and people working part-time but desiring a full work week.

After adjusting for annual revisions and adjustments to population estimates, the labor force participation rate was unchanged at 62.2% in January but remains below the February 2020 level of 63.4%. The employment to population ratio was little changed at 59.7%, also below the February 2020 level of 61.2%.

Overall employment in health care was up by 18,000 positions in January but is down by 359,000 or 2.3% from its February 2020 level. And within health care, nursing and residential care facilities was largely unchanged from December at 2.98 million positions but was down 120,000 from year-earlier levels.

—-

This blog was originally published on NIC Notes.

About NIC

The National Investment Center for Seniors Housing & Care (NIC), a 501(c)(3) organization, works to enable access and choice by providing data, analytics, and connections that bring together investors and providers. The organization delivers the most trusted, objective, and timely insights and implications derived from its analytics, which benefit from NIC’s affiliation with NIC MAP Vision, the leading provider of comprehensive market data for senior housing and skilled nursing properties. NIC events, which include the industry’s premiere conferences, provide sector stakeholders with opportunities to convene, network, and drive thought-leadership through high-quality educational programming. To see all that NIC offers, visit nic.org.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.