4Q22 Key Takeaways: Record Senior Housing Demand Drove Higher Occupancy

February 17, 2023

NIC MAP Vision clients, with access to NIC MAP® data, attended a webinar in mid-January on key seniors housing data trends during the fourth quarter and full year 2022. Findings were presented by the NIC Analytics research team. Key takeaways included the following:

Takeaway #1: Seniors Housing Occupancy Rose 0.9 percentage points in 4Q and 2.8 percentage points in 2022

- The occupancy rate for seniors housing—where seniors housing is defined as the combination of the majority independent living and assisted living property types—rose 0.9 percentage points to 83.0% from the third quarter of 2022 to the fourth quarter of 2022 for the 31 NIC MAP Primary Markets. This marked the sixth consecutive quarter of occupancy gains. At 83.0%, occupancy was 5.1 percentage points above its pandemic-related low of 77.8% recorded in the second quarter of 2021 but was still 4.2 percentage points below its pre-pandemic level of 87.1% in the first quarter of 2020.

- Demand as measured by the change in occupied inventory, or net absorption, was strong in the fourth quarter, increasing by 8,638 units in the Primary Markets after increasing by 8,513 units in the third quarter. For the full year 2022, net absorption totaled 27,845 units, which was the strongest annual demand ever recorded by NIC MAP Vision.

- Since the recovery began in the second quarter of 2021, 52,189 units have been absorbed on a net basis, surpassing the negative absorption that occurred following the onset of the pandemic when 45,411 units were placed back on the market on a net basis.

- For the full year 2022, following the record demand and strong net absorption, occupancy increased 2.8 percentage points from year-end 2021.

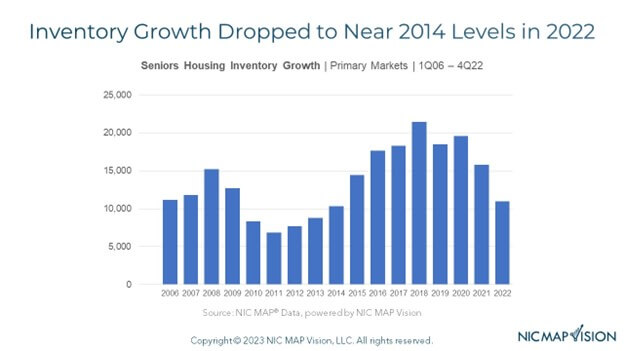

Takeaway #2: Inventory Growth Dropped to Near 2014 Levels in 2022

- Inventory growth has generally trended down from its high point of 21,440 units in 2018.

- Inventory growth in 2022 was a little under 11,000 units, a level of growth not seen since 2014.

- Between 2014 and late 2019 just before the pandemic began, inventory grew by an average of 18,056 units annually. The year 2022’s pace was down nearly 40% from those levels.

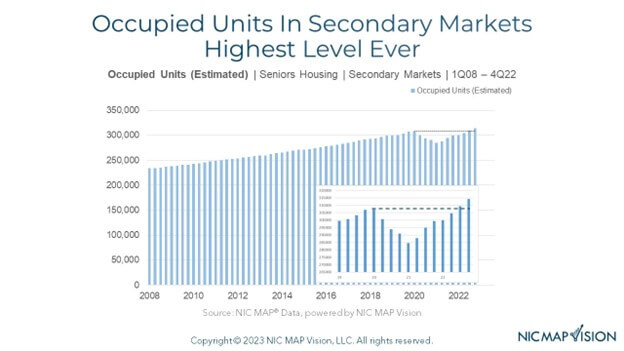

Takeaway #3: Occupied Units in Secondary Markets Highest Level Ever

- NIC MAP Vision defines Secondary Markets as Markets 32 through 99, or 68 large core based statistical areas (CBSAs) in the continental U.S. Each of these markets is generally smaller in population than any single one of the 31 Primary Markets.

- In 2022, occupied units in the Secondary Markets continued to increase, and in the fourth quarter reached an all-time high of 314,181, which was above their pre-pandemic high by 6,908 units.

- This trend shows that more older adults than ever before are residents in senior housing properties today, which speaks to the tremendous need for senior housing and care for aging adults, and the industry continues to meet that need.

Takeaway #4: Asking Rent Highest on Record for Assisted Living and Independent Living

- Same-store asking rates rose across NIC MAP’s Primary Markets by 5.5% from year-earlier levels for assisted living. This was the largest increase since NIC began reporting the data in 2005. Rates grew a bit less rapidly for independent living, but growth was still at a time-series high of 4.5% year-over-year.

- Third quarter wage rate data from the Bureau of Labor Statistics (BLS) show that average hourly earnings for assisted living employees increased by 9.0% from year earlier levels, much more than asking rent growth, but this 9.0% was down slightly from the roughly 10% year-over-year growth reported in the prior two quarters.

- The divergence between rent growth and wage growth has put significant pressure on NOI for many operators, as are rising costs of other expense categories, although there are signs that these pressures may be easing. For example, the widely followed consumer price index (CPI) rose by 6.5% for the twelve months ending in December, which marked the sixth consecutive monthly deceleration since a mid-2022 peak of 9.1% in June. Overall, however, inflation remains well above the roughly 2% average inflation rate that occurred in the three years before the pandemic.

Takeaway #5: Units Under Construction Least Since 2015

- In the fourth quarter of 2022, the number of senior housing units under construction in the 31 NIC MAP Primary Markets remained near its lowest level since 2015. This number totaled 35,719 units.

- For assisted living, there were 19,165 units under construction, down roughly 2,000 units from a year earlier. Note that this was the fewest units under construction since mid-2015. As a share of inventory, this amounted to 5.6%, which was well below its peak of 10.2% in late 2017.

- For independent living, there were 16,554 units under construction in the fourth quarter, equal to 4.7% of existing inventory compared to 6.7% in 1Q 2020.

- Overall, both inventory growth as described above and units under construction were quite moderate, retreating to levels not seen in more than five years.

View original article here.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.