Senior Living Costs: What’s Behind the Increase?

May 10, 2023

Senior living costs are up, according to data from NIC MAP Vision. The senior housing industry has been experiencing a trend of rising rent prices. But, why are costs going up? As with most real estate fluctuations, there are numerous reasons. In this article, we’ll go over what is currently driving up current senior living costs, and how you can use these findings to your advantage.

2023 Senior Housing Data

In the first quarter of 2023, the average asking rent for seniors housing was $4,958, a 5.3% increase compared to the previous year, marking the highest year-over-year increase in the history of data collection. Majority Assisted Living properties are up 5.9% compared to 4.8% for Majority Independent Living properties. This trend has been accelerating rapidly, with the average annual rate increase going from 1.3% year-over-year in the first quarter of 2021 to 5.3% year-over-year in the first quarter of 2023, the fastest pace of acceleration ever recorded.

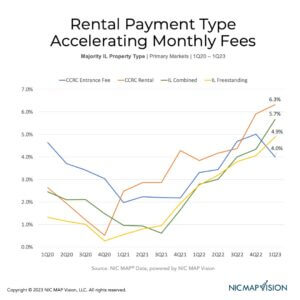

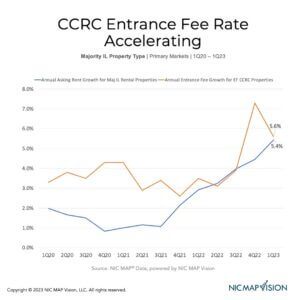

However, when Majority Independent Living communities are broken out by community type (chart 1) it becomes clear that Entrance Fee CCRCs are not accelerating their rates, monthly fees, at the same pace as rental communities. Instead, Entrance Fee CCRCs are relying more so on increases to Entrance Fees, which increased by 5.6% year-over-year in the first quarter and by 7.3% in the previous quarter, compared to the fourth quarter of 2021 (chart 2).

When excluding Entrance Fee CCRCs from Majority Independent Living communities the annual asking rent growth goes from 4.8% to 5.4%. This is key as traditional rental Independent Living communities are accelerating rates even higher than the top-line findings. The remainder of the analysis will focus exclusively on rental majority Independent Living communities.

When excluding Entrance Fee CCRCs from Majority Independent Living communities the annual asking rent growth goes from 4.8% to 5.4%. This is key as traditional rental Independent Living communities are accelerating rates even higher than the top-line findings. The remainder of the analysis will focus exclusively on rental majority Independent Living communities.

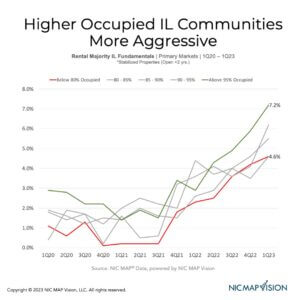

One of the key factors in rising rents, monthly fees, is the strong demand for seniors housing reflected in historic absorption volumes which have increased overall occupancy rates. As occupancy rates increase, senior living communities have more bargaining power to raise rates – a practical show case of supply and demand dynamics. Higher occupied communities are increasing rates greater than lower occupied communities. For example, Rental Majority Independent Living communities that are more than 95% occupied increased the annual asking rent growth by 7.2% in the first quarter compared to stabilized properties below 80% occupied which only increased by 4.6%.

Senior Rental Costs Are Up Too

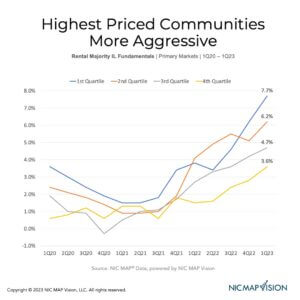

Similarly, Majority Independent Living communities with rent pricing based in the highest quartile, the top 75th percentile of communities based on their average monthly rent, are increasing rates faster than the lowest quartile, the bottom 25th percentile based on their average monthly rent. Rental Majority Independent Living communities in the top quartile of asking rents increased 7.7% compared to the bottom quartile which only increased 3.6% in the first quarter.

The analysis also revealed that for-profit rental Independent Living communities have aggressively accelerated their average asking rent since the end of 2021, and its pace of rent growth now exceeds not-for-profit communities. For-profit average asking rent increase for Rental Majority Independent Living communities was 5.7% in the first quarter compared to not-for-profit communities which were at 4.4%. However, the aggressive acceleration among for-profit communities is much different than not-for-profit which has been more gradual. Dating back to the start of 2021, For-profit communities, within Rental Majority Independent Living communities, have seen the annual asking rent change quicken from 0.6% to 5.7% two years later. By comparison, not-for-profit communities went from 2.4% to 4.4% in that same two-year period.

The analysis also revealed that for-profit rental Independent Living communities have aggressively accelerated their average asking rent since the end of 2021, and its pace of rent growth now exceeds not-for-profit communities. For-profit average asking rent increase for Rental Majority Independent Living communities was 5.7% in the first quarter compared to not-for-profit communities which were at 4.4%. However, the aggressive acceleration among for-profit communities is much different than not-for-profit which has been more gradual. Dating back to the start of 2021, For-profit communities, within Rental Majority Independent Living communities, have seen the annual asking rent change quicken from 0.6% to 5.7% two years later. By comparison, not-for-profit communities went from 2.4% to 4.4% in that same two-year period.

Another contributing factor to strong consumer demand is the increase in Social Security payments. The Social Security Administration announced a 5.9% cost-of-living adjustment (COLA) for beneficiaries in 2022, and an 8.7% adjustment in 2023. The 2023 adjustment was the largest increase in forty years. These adjustments are helping seniors and families continue to afford rising rents. Furthermore, senior housing operators will commonly use the increase in Social Security payments as justification among its resident population to help offset rising costs. Consumers’ openness to paying more for labor-related costs is also driving the trend of rising rent prices.

Another contributing factor to strong consumer demand is the increase in Social Security payments. The Social Security Administration announced a 5.9% cost-of-living adjustment (COLA) for beneficiaries in 2022, and an 8.7% adjustment in 2023. The 2023 adjustment was the largest increase in forty years. These adjustments are helping seniors and families continue to afford rising rents. Furthermore, senior housing operators will commonly use the increase in Social Security payments as justification among its resident population to help offset rising costs. Consumers’ openness to paying more for labor-related costs is also driving the trend of rising rent prices.

Senior Living Costs and Labor Costs

Senior living communities rely heavily on labor, and with labor costs rising, communities must adjust their rent prices. Rising labor and material expenses also contribute to the increase in rent prices as operators and investors seek to offset higher costs with higher prices. According to the Bureau of Labor Statistics, the cost of labor in the senior living industry rose by 5.0% year-over-year by the end of 2022 and has increased by 11.2% in a two-year period. Communities are passing most of those costs onto residents through higher rent prices.

Inflation is also a major factor in the rise of rent prices in seniors housing. The Consumer Price Index (CPI) started accelerating sharply in the spring of 2021 and peaked at 9.1% in June 2022. The CPI remained between 6.5% and 9.1% for all for 2022, the highest in forty years. Rising inflation affects the cost of goods and services across all industries, including seniors housing. The cost of supplies such as food and kitchen, medical and personal care, office and administrative, and technology and communication needed to operate a senior living community have increased, and communities are adjusting rent prices to reflect the rise in expenses.

Decline in New Construction Effects Senior Living Costs

Lastly, declining new construction is another factor contributing to the trend of rising rent prices. New construction in senior living has slowed in recent years, leading to a decrease in the supply of under construction senior living units. As the demand for senior living continues, communities may be adjusting rent prices to compensate for the lack of available units. As a comparison, following the 2008 financial crisis, the percentage of seniors housing units under construction hovered between 2.0% to 4.0% from 2010 to 2014. During this period, the seniors housing annual rent growth accelerated from 1.3% to 2.6%. The percentage of seniors housing inventory under construction today is still much higher at 4.9%, but new construction starts are declining, and the percentage of inventory under construction is likely to decline through 2023.

While the research findings indicate a trend of rising rent prices in seniors housing, absorption volumes following the pandemic suggest strong consumer demand which has led to higher occupancy rates. The number of seniors living in a senior living community is the highest it’s ever been, approaching 900,000 occupied seniors housing units in primary and secondary markets as of the first quarter. This is a positive sign for the industry and highlights the necessity for quality senior living options. As the industry continues to evolve and adapt to meet this demand, we can expect to see more innovative and diverse seniors housing options available to seniors. Moreover, higher occupancy rates can lead to more socialization and community involvement, which has been shown to have positive effects on seniors’ health and well-being.

Putting Senior Housing Real Estate to Use

Now more than ever, the actionable data provided by NIC MAP Vision can help you stay informed. With market prices swelling, and senior living costs rising, it is vital to attain a complete understanding of today’s senior housing market. Contact a NIC MAP Vision product expert today to see how our product solutions can ensure your business stays successful in this competitive market.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.