Skilled Nursing Occupancy at 74.0% in September: Many properties need more federal funding to survive the pandemic

December 9, 2020

NIC MAP released its latest Skilled Nursing Monthly Report on December 2, 2020, which includes key monthly data points from January 2012 through September 2020.

Here are some key takeaways from the report:

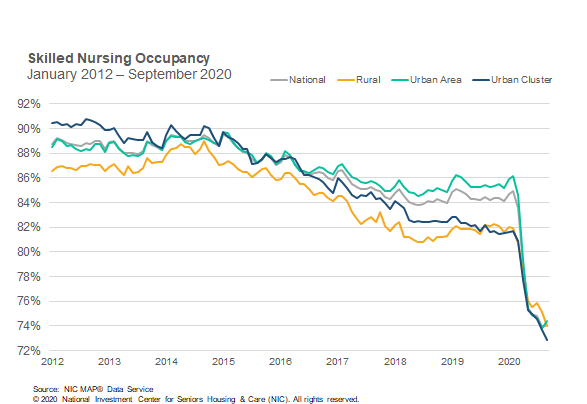

1. Occupancy challenges continue for skilled nursing properties as the occupancy rate stood at 74.0% in September 2020, the most updated figure from this survey. While up 12 basis points from 73.9% in August, the September level was 10.9 percentage points below the recent February peak of 84.9%. Since February, the COVID-19 pandemic has significantly impacted skilled nursing operations across the country. Occupancy is down 10.2 percentage points from the September 2019 level of 84.2%.

2. The decline has been more severe in urban areas as occupancy fell 11.8 percentage points since February versus the 8.0 percentage point decline in rural areas in that same period. As the country and the skilled nursing sector navigate through the coming fall/winter months, COVID-19 cases are likely to continue to grow and could further pressure occupancy lower. The funds from the CARES Act and other implemented policies, such as the 3-Day waiver, have helped to support skilled nursing properties thus far and into the first nine months of the pandemic, but additional stimulus is most likely needed for many operators to make it through to the other side of the pandemic.

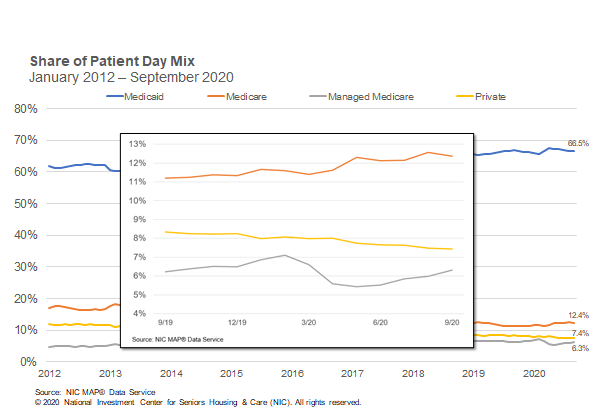

3. Managed Medicare patient day mix increased 33 basis points to 6.3% in September 2020 after hitting a 7-year low during the pandemic of 5.4% in May. However, it is down 29 basis points since March and has decreased 78 basis points since its record high point in February of 7.1%. The increase since May suggests managed Medicare admissions have increased since the lows of the pandemic, but they are likely significantly below levels prior to the pandemic. As cases of COVID-19 continue to grow and some states implement restrictions once again, it is possible that managed care patient days are further pressured if elective surgeries are suspended again. In addition, managed Medicare revenue mix increased 61 basis points from August to September to 8.8%. However, it is has declined 110 basis points since March and 188 basis points since February, when it was 10.7% before the pandemic started. At its peak in March 2019, it was 11.8%.

4. Medicare revenue mix increased slightly from August to September, ending at 21.8%. Medicare revenue mix has held up relatively well since the pandemic began in March, compared with other payors. It is up 46 basis points since March compared to managed Medicare (down 110 basis points) and private (down 134 basis points). In addition, skilled mix has increased 47 basis points since March driven by the increase in Medicare patient day mix. Medicare patient day mix decreased slightly from August to end September at 12.4%. However, it has increased 97 basis points since March. As overall occupancy has declined dramatically during the pandemic creating significant pressure on skilled nursing operators, Medicare patient days likely did not decrease as much as it would have given that the Centers for Medicare and Medicaid Services (CMS) waived the 3-Day Rule, which waives the requirement for a 3-day inpatient hospital stay prior to a Medicare-covered skilled nursing stay.

To get more trends from the latest data you can download the Skilled Nursing Monthly Report here. There is no charge for this report.

The report provides aggregate data at the national level from a sampling of skilled nursing operators with multiple properties in the United States. NIC continues to grow its database of participating operators in order to provide data at localized levels in the future. Operators who are interested in participating can complete a participation form here. NIC maintains strict confidentiality of all data it receives.

About Author Bill Kauffman, NIC

Senior Principal Bill Kauffman works with the research team in providing research and analysis in various areas including sales transactions and skilled nursing. He has lead roles in creating new and enhanced products and implementation of new processes. Prior to joining NIC he worked at Shelter Development in investing/acquiring, financing, and asset management for over $1 billion in assets. He also had key roles in the value creation and strategic planning and analysis for over 65 entities. He received his Bachelor of Business Administration in Finance from the College of Business and Economics at Radford University and his Master of Science in Finance from Loyola College in Maryland. He also holds the Chartered Financial Analyst Designation (CFA).

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.