Skilled Nursing Occupancy Increases in February 2022

May 5, 2022

NIC MAP® Data, powered by NIC MAP Vision, released its latest Skilled Nursing Monthly Report on May 5, 2022. The report includes key monthly data points from January 2012 through February 2022.

Here are some key takeaways from the report:

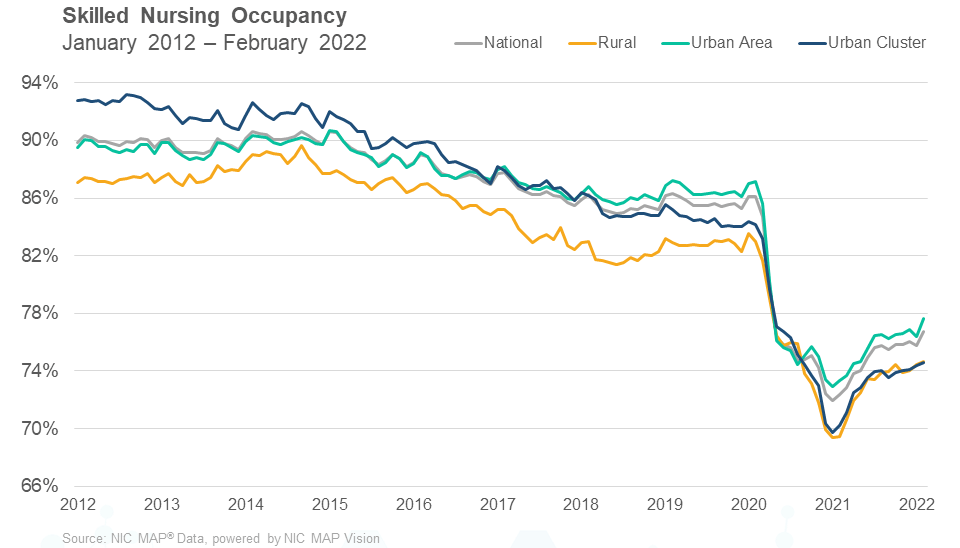

Skilled nursing property occupancy increased 94 basis points in the month of February, ending the month at 76.7%. This was the highest occupancy level since April 2020, at which time occupancy began to fall rapidly due to the onset of the pandemic. Occupancy continues to recover since the pandemic low of 71.9% set in January 2021 but has encountered challenges given the Delta and Omicron variants. In addition, staffing shortages have created significant difficulties within skilled nursing properties limiting the ability to admit new residents. However, the current occupancy trend does suggest that the demand for skilled nursing properties is recovering, given the 94-basis point increase from January to February. Occupancy has increased 439 basis points from one year ago and 480 basis points from its pandemic low.

Managed Medicare revenue mix increased 83 basis points in the month of February, ending the month at 11.4%. This the highest level since March 2019. This increase, along with improving overall occupancy and rising managed Medicare patient day mix, suggests higher demand from managed Medicare beneficiaries for skilled nursing care. Managed Medicare revenue mix has risen three months in a row and is 151 basis points above its November 2021 level. Patient day mix also trended upward over the past three months, increasing 125 basis points to end February at 8.5%. Meanwhile, managed Medicare revenue per patient day (RPPD) increased in February to $450. The fact that RPPD increased in a month that COVID-19 cases were declining, may suggest higher acuity patient care in February.

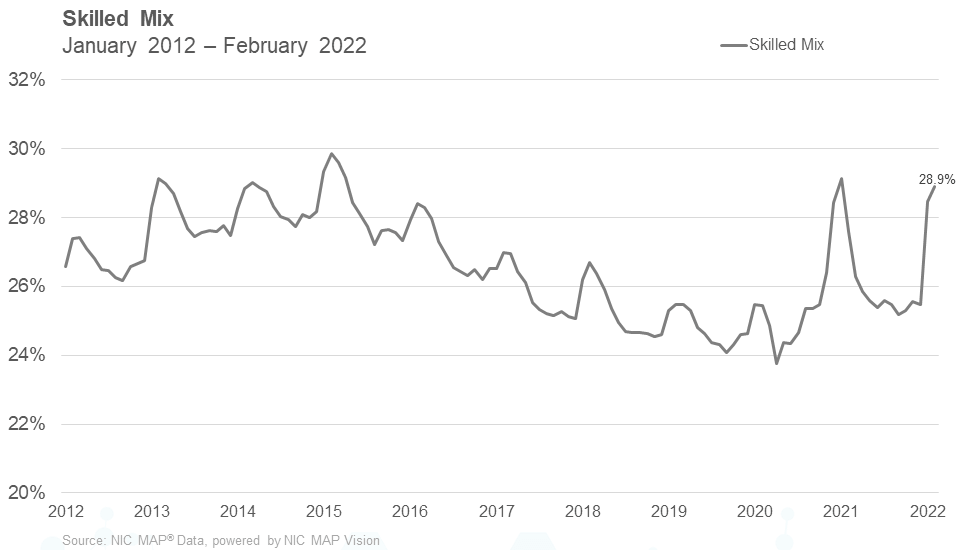

Skilled mix increased 41 basis points from January to end February at 28.9%. This increase seemingly was driven by both Medicare and managed Medicare patient day mix as they each increased from the prior month. However, managed Medicare was the main driver as the patient day mix increased 66 basis points from 7.8% and Medicare only increased 26 basis points from 13.7%. In addition, Medicare revenue mix increased 14 basis points to end February at 24.6%, after it increased significantly (386 basis points) from December to January when skilled nursing operators utilized the 3-Day Rule waiver as COVID-19 cases increased in the month of January.

Medicaid patient day mix decreased for the second month in a row, falling 33 basis points from January to end February at 63.3%. Its patient day mix has declined 163 basis points from one year ago, while Medicare patient day mix increased 68 basis points. Some of the explanation of this yearly decline in Medicaid patient days is due to the spike in Omicron cases in January as operators moved residents from Medicaid to Medicare days as they required isolation and higher skilled care.

Get more trends from the latest data by downloading the Skilled Nursing Monthly Report. There is no charge for this report.

The report provides aggregate data at the national level from a sampling of skilled nursing operators with multiple properties in the United States. NIC continues to grow its database of participating operators to provide data at localized levels in the future. Operators who are interested in participating can complete a participation form on our website. NIC maintains strict confidentiality of all data it receives.

—-

This blog was originally published on NIC Notes.

About NIC

The National Investment Center for Seniors Housing & Care (NIC), a 501(c)(3) organization, works to enable access and choice by providing data, analytics, and connections that bring together investors and providers. The organization delivers the most trusted, objective, and timely insights and implications derived from its analytics, which benefit from NIC’s affiliation with NIC MAP Vision, the leading provider of comprehensive market data for senior housing and skilled nursing properties. NIC events, which include the industry’s premiere conferences, provide sector stakeholders with opportunities to convene, network, and drive thought-leadership through high-quality educational programming. To see all that NIC offers, visit nic.org.

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.