Understanding the Trends: Exploring Historical Performance with Freestanding Vs. Combined Campus-Type Senior Housing

April 1, 2024

In the next ten years, the number of Americans reaching their eighties will grow by 4.3 percent every year, or 7.3 million people—increasing demand in the senior housing market.

To prepare, operators must examine the market data and consider trends in development and performance for the different types of available senior housing—especially for freestanding and combined campus-type housing.

Here is a look at development trends for these housing types, as well as an analysis of how they are performing.

Freestanding Senior Housing Options: How They Are Performing

Availability

Overall, both historical trends and more recent data tracking occupancy within the senior housing market still favor the freestanding campuses for both the assisted living and memory care market segments.

These freestanding properties mostly skew toward smaller campus sizes, smaller units, and lower rents. Generally speaking, freestanding housing options are a good fit to take care of a senior’s immediate needs, separate from seniors who need other levels of care.

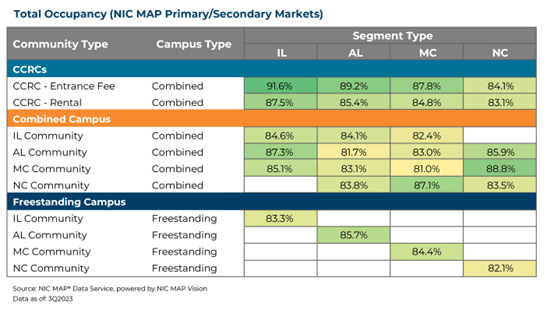

But what about the occupancy of these senior housing options? Newly released Q3-2023 data from NIC MAP Vision reports the following:

- Freestanding independent living communities had 83.3% occupancy

- Freestanding assisted living communities had 85.7% occupancy

- Freestanding memory care facilities had 84.4% occupancy

- Freestanding nursing care facilities had 82.1% occupancy

Market Segmentation

Each of these freestanding senior housing options generally cater to only one segment of the entire market—usually independent or assisted living facilities.

Safety in Options: The Ongoing Development of Rental Continuum Communities

Because combined campus housing assists with more of a continuum, their statistics a

re not quite so cut-and-dry, as they meet the needs of both primary and secondary markets in the same facility.

Market Segmentation

The majority of rentals in these combined campus-style housing options address the needs of a particular market segment—but even so, some are a blend of two or more segments, including independent living paired with options for more extensive care like assisted living.

The Allure of Independent Living

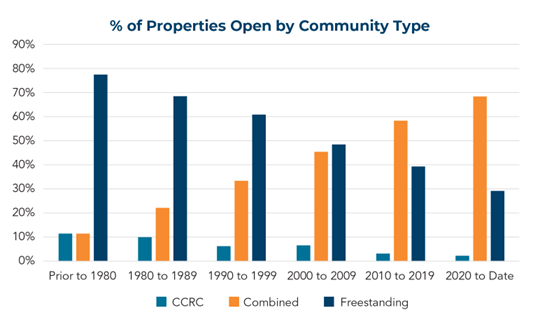

Combined campus senior housing options are growing when the majority of units are independent living options. This trend growth is paired with to the dramatic decline of the new development of continued care retirement communities (CCRCs). Much of this development has been replaced with new development of combined campus-style housing since CCRCs offers varying levels of support but do not offer the same flexibility to choose from independent living options or more skilled nursing care within the same community, which is a choice that’s afforded to residents who opt for combined campus senior living.

Making Sense of It All: What This Senior Housing Market Data Means

Stability and Trends in New Development

Within Majority Independent Living communities, freestanding independent living communities have consistently made up between one-third and one-half of all new developments over the past three decades. However, this downward trend is happening everywhere; even the development of freestanding IL communities is on the decline. Even so, data suggests that there will always be a certain, stable level of demand for freestanding housing.

An Increase in Combined Campus Occupancy

Combined campus independent living options are becoming increasingly popular—and operators are taking note.

During the COVID-19 pandemic, independent living occupancy in combined campuses fell faster than in freestanding campuses. However, the occupancy rates for combined campus independent living facilities exceeded freestanding campus occupancy rates by the first quarter of 2022 and have remained higher ever since.

Overall, combined campuses are having a stronger post-pandemic recovery which has led to a higher overall occupancy rate than freestanding IL campuses. This may be why a combined campus style is more common with new developments.

The Takeaway

When examining and breaking down historical trends, senior living operators should note that combined campuses have one selling point that freestanding campuses don’t—which may be a key determining factor in why their occupancy rates vary. Combined campuses offer seniors a whole continuum of care—including security and accessibility.

Combined campuses offer care that ranges from independent living to skilled nursing care, which allows residents to age in place and transition between levels of care as their needs change, all without having to move to a new community.

Having multiple levels of care in one location can also be more convenient for couples who have different care needs, and also for residents who want to stay in a familiar environment. This is primarily true for couples entering a community at the independent living level.

Combined communities can offer a more efficient use of resources, facilities, and staff, as they cater to a broader range of needs.

Additionally, the combined campus market segment has a built-in lead funnel from other segment types to attract residents—while freestanding campuses do not.

Get Senior Housing Marketing Intelligence with Detailed Analysis from NIC MAP Vision

This in-depth look at senior housing market data can make all the difference for operators. Operators can benefit from the analysis of any market, site, or portfolio to make better-informed decisions—with more confidence and in less time. This can be critical when planning future development and determining what kind of senior housing facilities will be most in demand in the coming years.

- Learn more about NIC MAP Local, an entire database dedicated to properties and sales transactions. This insights tool grants operators and other senior living professionals access to data they need to assess a specific market. NIC MAP Vision tracks more than 35,000 properties nationwide, with rate and occupancy data provided for 140 markets in a single source.

- NIC MAP Trends provides operators with historical market tendencies to inform decision-making. It leverages the longest time-series data available to build historical trend data that can be analyzed by property, community, or segment type.

Discover how a data-backed analytics platform can support your operations, save you time in an increasingly competitive market, and help you make the right decisions for your senior housing community. To learn more, connect with one of our product experts today!

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.